As a consumer, living in a cashless society is great. You can pay for almost anything with your credit card, get refunds on qualified purchases, and earn points for your spending.

Unfortunately, I can’t say the same for business owners. They have to rent or buy the terminal, buy the thermal paper for the receipt, and pay a bunch of different fees and charges they hardly understand to process card transactions.

If you’re thinking of shopping around to find a good quote, forget it. Payment processors issue quotes on a per case basis, and many of them use ‘bundled’ pricing so it’s hard to compare quotes from one processor to another.

A quote for $450 a month can balloon to $800 or more depending on the number of transactions you process and the cards you accept.

The payment processing industry is brimming with misleading information, and vague pricing models. Unprofessional sales agents peddle shady contracts to unsuspecting business owners.

An Unlikely Advocate for Entrepreneurs

Ben Dwyer started Cardfellow to address these problems.

It started as a blog to help business owners understand how payment processing works. To help more businesses connect with the right payment processors, Dwyer created an online marketplace in 2007.

But the new-found marketplace wasn’t always immune from the unethical practices of the industry. Payment processors used the same quotes they offered outside of the marketplace. The entrepreneurs who signed up didn’t know the right questions to ask, so they couldn’t negotiate pricing and terms properly.

That’s why Cardfellow created a contract that dictated the pricing model and terms processors could use for their marketplace.

How it Works

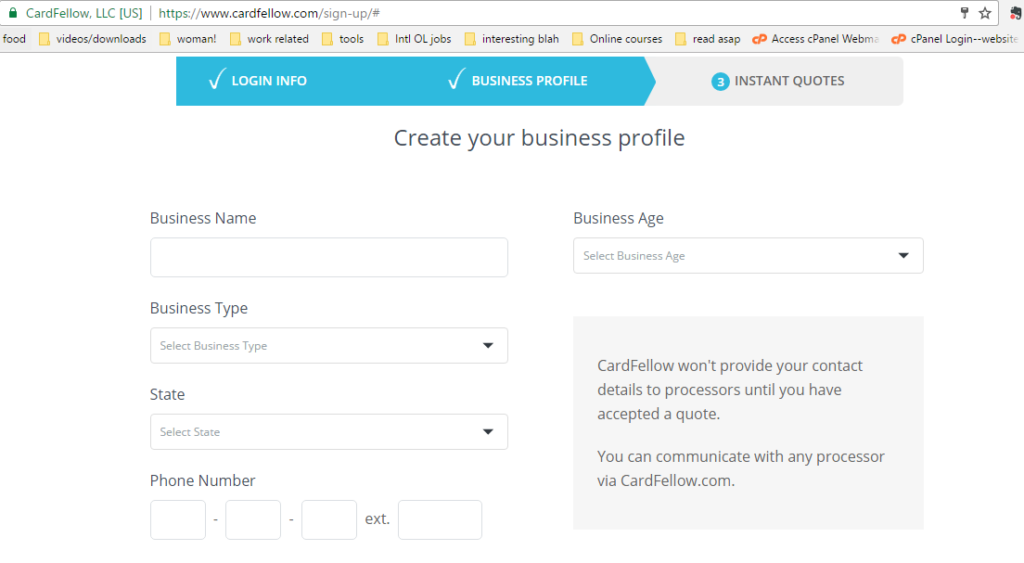

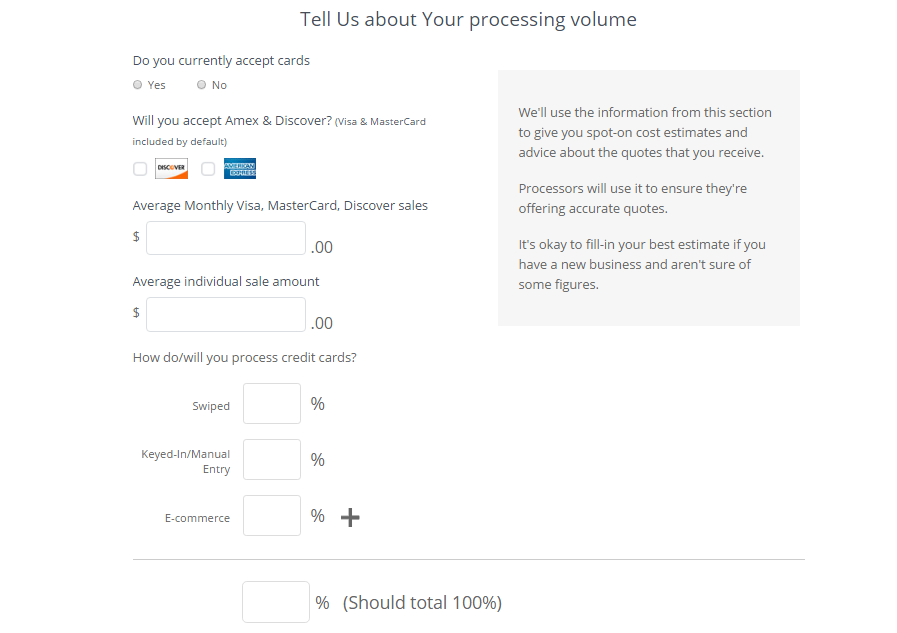

1. Sign Up

Sign-up for a free account then fill out your details. It’s important to complete the business profile accurately, so you can receive quotes tailored to your operations.

Think this is too much information for a quote? Other payment processors don’t ask for these details online. But that’s only because they will have a sales agent call you afterwards. Then you’ll be at the mercy of their follow-up sales calls and explanation skills.

Transaction volume, average amount per sale, and the types of card you accept all factor into the different charges associated with payment processing. You’ll see this later in the quotes they provide.

2. Compare Quotes

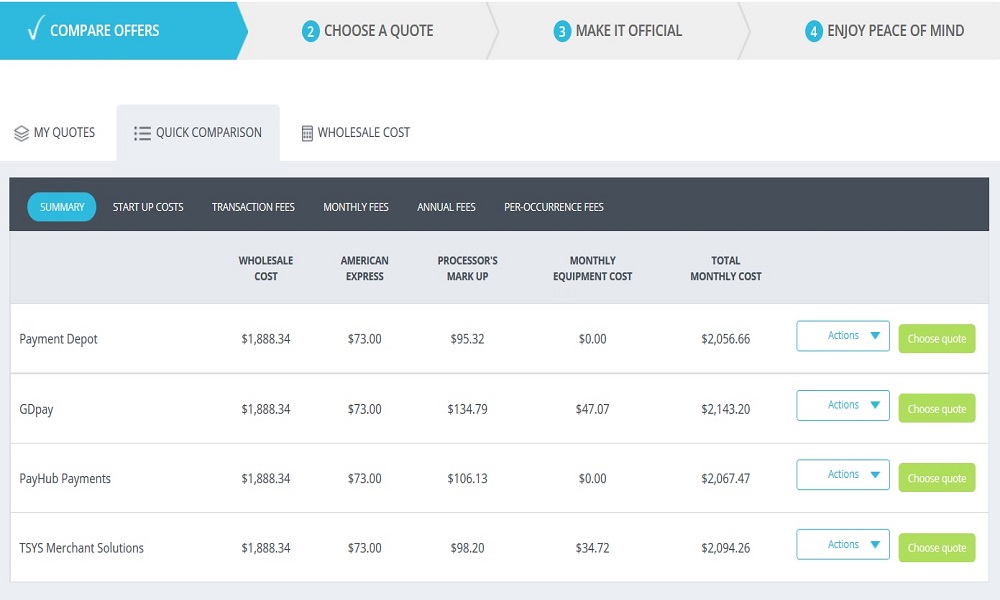

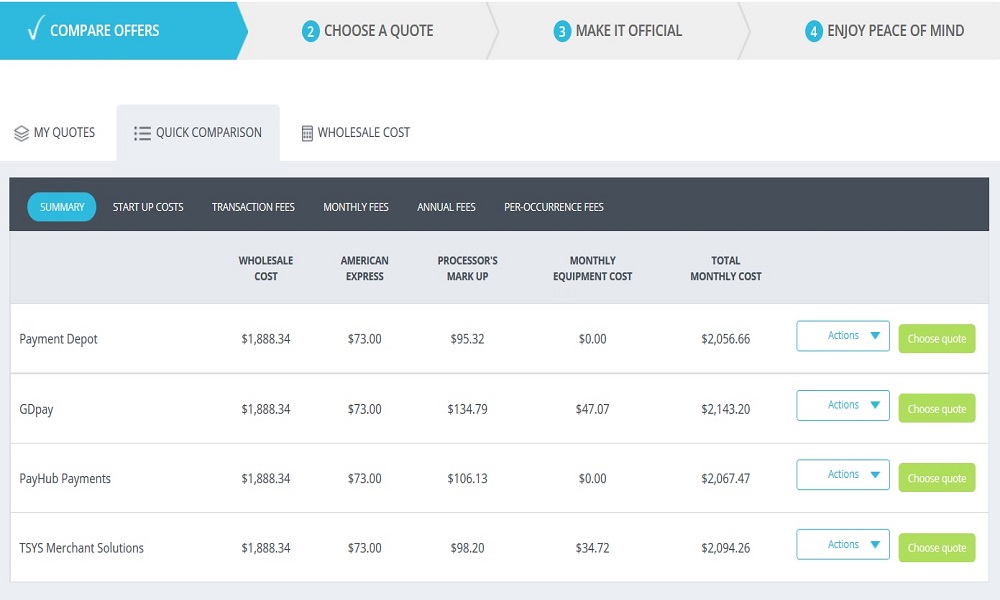

You’ll receive three to four instant quotes from hand-selected merchants as soon as you complete the registration process.

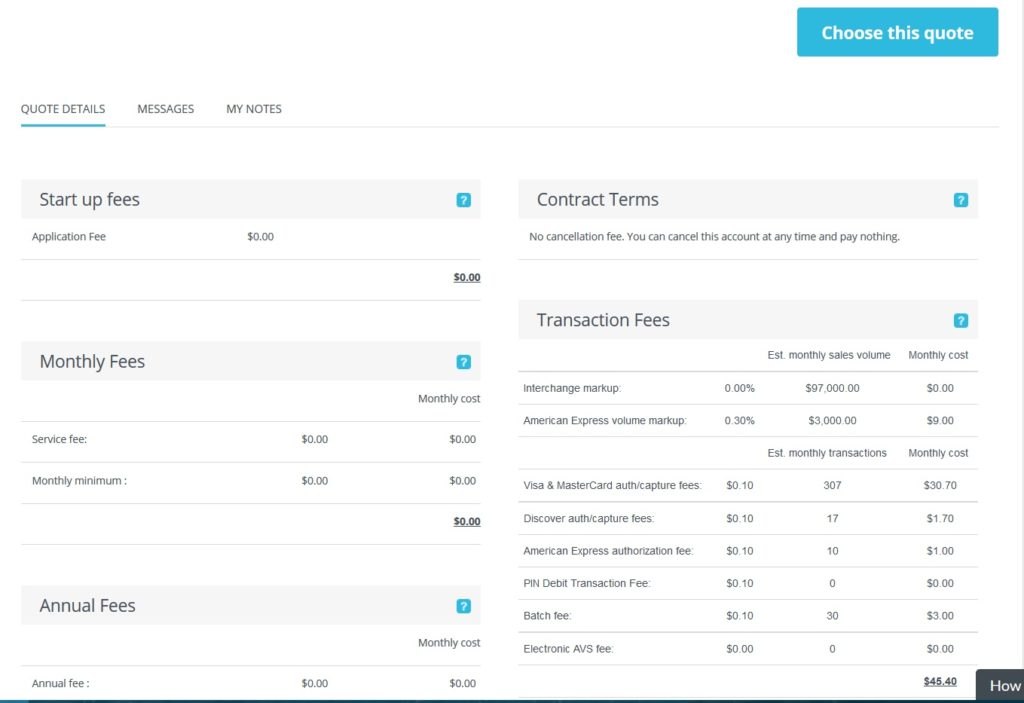

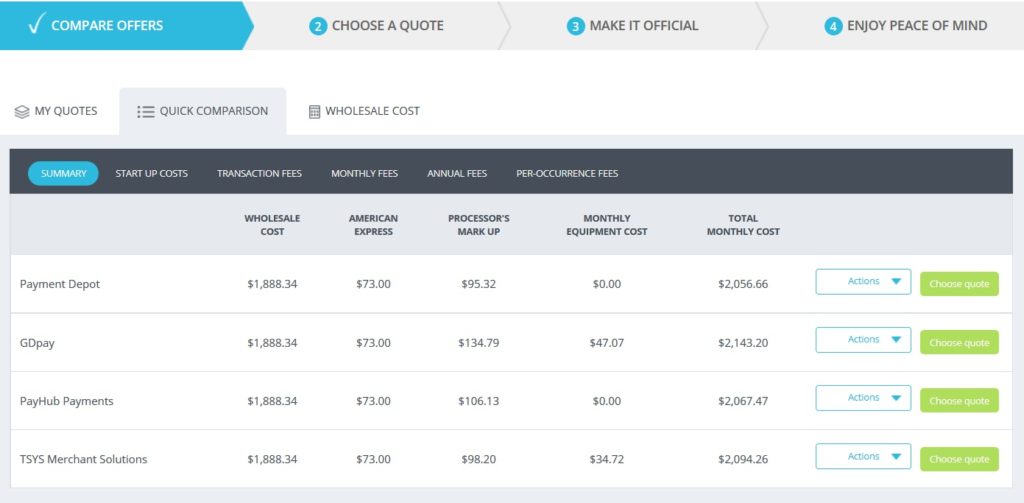

To ensure transparency, quotes from each payment processor include a breakdown of fees and charges. It’s also based on the information you provide upon registration. For instance, you’ll see how much you’re likely to pay for a certain amount of Visa transactions.

You could also compare the cost summary side-by-side with other providers.

If you want more options, you can request for more quotes, or invite a payment processor of your choosing to submit a quote via Cardfellow’s marketplace.

Cardfellow also offers free consultation service. You can reach out via phone, email, or chat if you have questions about the quotes, processing fees, or how the service works.

Dwyer says, “Speaking over the phone is the best way to convey the complexities of processing fees.”

True to his word, Dwyer doesn’t shy away from taking a hands-on approach. Several reviews online show customers complimenting him from taking the time to educate customers about the fees.

Changing the Payment Processing Industry

Cardfellow isn’t a payment processor, it’s a middleman. But unlike many middle mans, they don’t just take their profit and leave customers hanging.

They’ve changed the merchant payment processing industry by offering exclusive benefits you won’t find anywhere else:

Certified Quotes

All payment processors must abide by a legal agreement Cardfellow created to protect business owners using the platform. Aside from detailed quotes in interchange-pricing model, this contract also requires processors to provide quotes with:

Locked in rates

The fees quoted to you are locked-in for the duration of your account with the payment provider. They can’t give you any excuse to increase what you’re already paying.

No cancellation fees

All contracts are on a month-to-month basis and must have no cancellation fees. You’ll receive a cancellation fee waiver after you complete all the paperwork required.

With all the restrictions imposed on payment processors, you might think that very few companies are willing to work with them. But it’s the complete opposite.

“It’s a win-win. Processors willing to abide by our legal agreement can place quotes for a larger pool of merchants, while the businesses can be confident knowing they’re protected by our agreement, and have us on their side”, says Ellen Cunningham, Marketing Manager at Cardfellow.

Rate monitoring

Rates and charges billed to you are monitored periodically, so processors won’t dare bump you up a different pricing range.

Anonymous message board

Cardfellow protects your privacy and business information, but they don’t hinder you from reaching out to processors. There’s a private message board for each quote you receive. You can ask questions directly to the processor without revealing your contact details. It’s a great way to clarify their offer without getting bombarded with sales calls later on.

Trying to do Good in an Industry with a Bad Rap

If it all sounds too good to be true for you, you’re not alone in that thinking.

“Many entrepreneurs have been burned by processors in the past, they can’t believe they found competitive pricing and terms through Cardfellow in just a few minutes,” says Dwyer.

It’s also hard to escape the industry’s shady reputation, despite their efforts to educate their customers.

“The complexity of processing fees, the wrong information people have picked up from high-pressure sales people, and the general stigma surrounding the industry makes the competitiveness of Cardfellow’s quotes tough for people to recognize,” he continues.

A Different Way of Earning Commission

The average business owner will change processor every few years, or depending on when their contract allows them to switch processors without incurring any fees. That’s why sales agents will tell you whatever you want to hear to close the sale.

It’s also why it’s in the card processor’s interest to keep their fees and pricing structure vague, so they could extract as much money from you before you jump ship to their competitor.

Cardfellow earns commission over time. That’s why they invest so much of their time and resources in helping entrepreneurs connect with the best payment processor.