Deprecated: Implicit conversion from float 1752881191.981527 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Deprecated: Implicit conversion from float 1752881191.981613 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

If you’re using a checking or savings account to save for college… there’s something you should know. There’s a better alternative that offers investment returns, tax benefits, and more: A 529 College Savings Plan.

A 529 College Savings Plan is a tax-advantaged investment account that helps you prepare for college.

Here’s How It Works

You contribute post-tax dollars, it grows tax-free, and then you can withdraw the money tax-free to pay for higher education. While there is a 10% penalty and taxes on your earnings for non-qualified withdrawals, the rules are more flexible than you might think.

Why is this better?

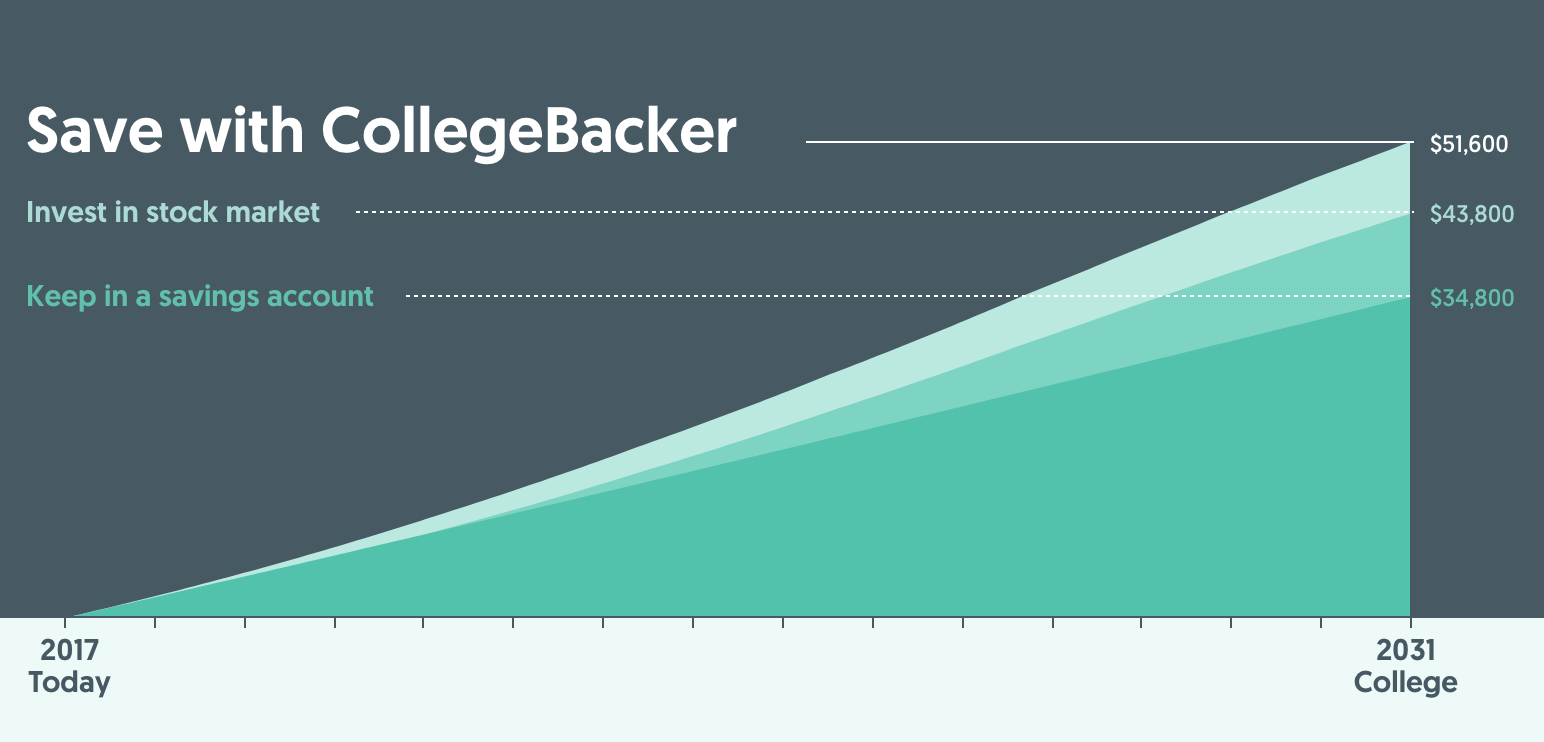

Imagine you’re putting away $200 per month for your 5-year-old’s college education. Over the next 13 years using a savings account, you would earn interest, but it might not keep up with inflation. If you invest the money in a taxable account, you’ll pay capital gains tax on your investment returns.

With a 529 College Savings Plan, your investment returns are tax-free – which can add up to tens of thousands of dollars if you start saving early.

Visit CollegeBacker.com to experiment with custom calculators to visualize the difference:

WHAT ARE THE RULES?

Before opening a 529 plan, it’s important to understand the rules. As we mentioned earlier, any non-qualified withdrawals will trigger a 10% penalty and taxes on the earnings, but the rules are more flexible than you might think:

- You can contribute up to $14,000 per year without any adverse tax consequences. In fact, you can actually “superfund” an account by contributing $70,000, or five years’ worth of contributions, in a single year.

- You can spend the money on much more than tuition. Qualified expenses include tuition and fees, room and board, books, computer technology and related equipment, and special education expenses.

- In terms of type of institution, you can spend the money at trade, undergraduate, and graduate schools – in all 50 states, and even many institutions abroad. Any higher education institution qualifying for federal financial aid is allowed. Here’s the full list.

- You can change the beneficiary to another family member. This is great if you have money left over after your first child graduates, or if your child decides not to go college. You can even make yourself the beneficiary.

- If your child earns a scholarship, you can also withdraw the amount of the scholarship without the 10% penalty. You will, however, need to pay taxes on the earnings, so it’s even smarter to spend this money on the qualifying expenses listed above.

HOW DO I GET STARTED?

With over a hundred different options for 529 plans, selecting the right one can be confusing. If you’re doing the research on your own, here are a few guidelines:

Check if your state has a significant tax deduction for using your in-state plan. If not, look for a plan with low fees, a track record of stable management, age-adjusting portfolio options, and tools that make it easy for others to contribute (so you can turn birthday parties and holidays into college funding opportunities).

If you’re overwhelmed by the options, resist the urge to go back to a savings account! We built CollegeBacker to make it easy to find a great plan, choose the right investment portfolio, and invite family and friends to help you save.

Photo credit: Got Credit Savings via photopin (license)