Deprecated: Implicit conversion from float 1752880889.348861 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Deprecated: Implicit conversion from float 1752880889.348962 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

The recent selloff in both stocks and bonds is a reminder to question conventional wisdom in portfolio diversification. The rush to yield pushed both asset classes into the stratosphere over the last several years. As prices increased, dividend yields and bond yields decreased.

While stocks and bonds are still critical long-term investments to meet your investing goals, investors may need to look outside the box for returns and safety in diversification.

One new asset class is stepping in to fill the void and help investors get needed diversification without sacrificing returns.

Investing In The Peer Lending Revolution

Peer to peer lending sites have already changed lending for borrowers, offering a convenient solution to borrowers of all credit scores.

Lenders from small upstarts to large banks like Goldman Sachs are getting into the business as well. With physical branch costs accounting for up to a third of lenders’ operating costs, originating online loans is as much as 4% cheaper than traditional lending.

The peer lending revolution has also been an opportunity for investors. Investing in bank loans is nothing new but previously had to be done through bundling of loans by the bank or a broker, each taking their cut of the profits.

Going directly to the borrowers to invest in loans through the peer lending sites means investors know exactly which loans are in their portfolio and can manage risks with return…then there’s the 7%+ return on Lending Club platform loans since 2007, which is nice!

Peer Lending Investing Returns

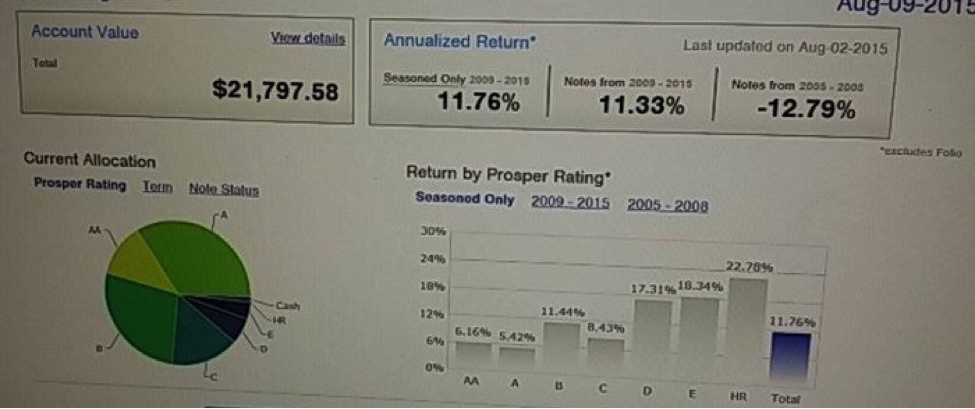

P2P investing got off to a rough start leading up to the financial crisis. Defaults jumped through 2008 but then so did defaults on just about every other type of loan. My own returns over the three years through 2008 were negative but still didn’t approach the bloodbath seen in the stock market.

Returns since 2009 have been much better with Lending Club reporting an annualized 7.56% return on all loans. My own returns have been nearly 12% by filtering the loans in which I invest by just a few criteria.

We’ll get to those five criteria pretty soon but there’s another reason to invest in peer loans besides the returns. P2P investing is also a good way to diversify your risk from a portfolio of stocks and bond funds.

Since peer loans are a debt obligation, they should be less volatile than stocks barring another cataclysmic debt crisis. Loans are relatively short-term at just 3-5 years so they have less interest rate risk compared to longer bonds.

Five P2P Loan Criteria for Higher Returns

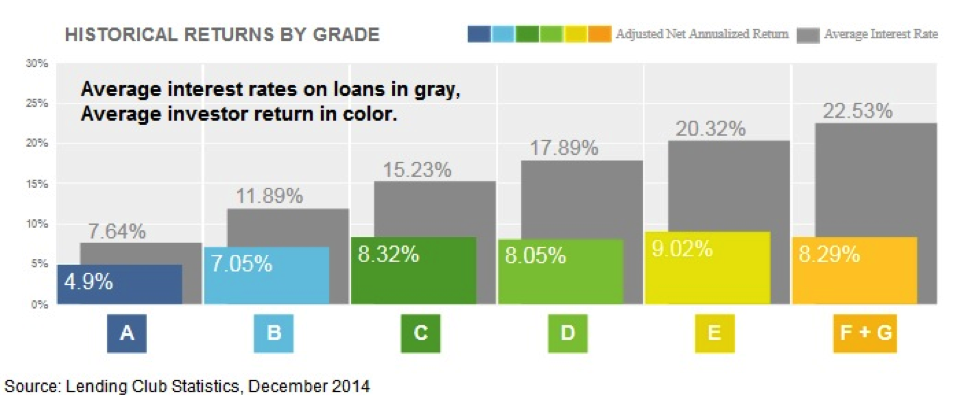

There’s nothing wrong with investing across all the loans originated on one of the peer lending platforms. Returns on all Lending Club loans over the last few years have provided a 7.17% annual return and low 6.4% rate of default.

Filtering the loans in which you invest by just a handful of criteria can significantly boost your returns. The largest platforms offer dozens of criteria from which to filter loans but I’ve found many don’t make much of a difference in being able to increase returns and lower risk. I’ve narrowed it down to just five that I use on a regular basis.

- Categories C through E on Lending Club – These are a good tradeoff between higher risk borrowers but which are still a good credit risk. Notice that while the highest-risk category of borrowers pay a higher rate, the return is lower because of higher defaults.

- Max debt-to-income of 30% – This means borrowers are paying less than a third of their income to paying off debt. On a standalone basis, it raises the return on loans to 7.3% and lowers loss to a 6.2% default.

- No delinquencies or credit inquiries last six months – If a borrower has already walked away from a loan it might be just as easy for them to default on the p2p loan. I also try to avoid borrowers that look like they are scrambling for money, applying for other credit within the last six months. On a standalone basis, it raises the return on loans to 7.52% and lowers loss to a 5.6% default.

- Home ownership – Owning or carrying a mortgage on a home is a sign of stability and that the borrower is managing another debt obligation. On a standalone basis, it raises the return on loans to 7.65% compared to all loans.

- Annual income over $70,000 – This is near the average income for borrowers on Lending Club so I want to filter loans by those making more. On a standalone basis, it raises the return on loans to 7.57% and lowers loss to a 5.65% default.

By themselves, each of these criteria may not move the needle much on returns. Together they have helped me increase my returns by three to five percent over the average of all loans on the p2p platforms.

I generally recommend that investors aim for over 100 loans in their portfolio and no loan accounting for more than 1.5% of their money invested. Even the safest category of loans sees some defaults but spreading your money around means that no singular default will wreck your returns.

Most investors are still a little hesitant about getting into peer loan investing but it could be a mainstream asset class within a few years. Besides strong returns and cash flow, the loans provide diversification from a portfolio of stocks and bonds.

Review your own risk tolerance and return needs to decide which types of loans are right for your portfolio.

Photo credit:

InvestmentZen via Flickr – Creative Commons Attribution License

1 Comment