Deprecated: Implicit conversion from float 1757912986.443799 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Deprecated: Implicit conversion from float 1757912986.44396 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

According to a 2015 study from Bankrate.com, more than 50 percent of Americans don’t invest at all – as in, they don’t stash away a single cent.

This figure, while not all that surprising, highlights the magnitude of the retirement crisis brewing in America. With less than half of the adult population making any sort of investments, it’s easy to wonder what might happen to those who don’t.

Of course, it helps to understand the underlying issues that prevent people from investing in the first place.

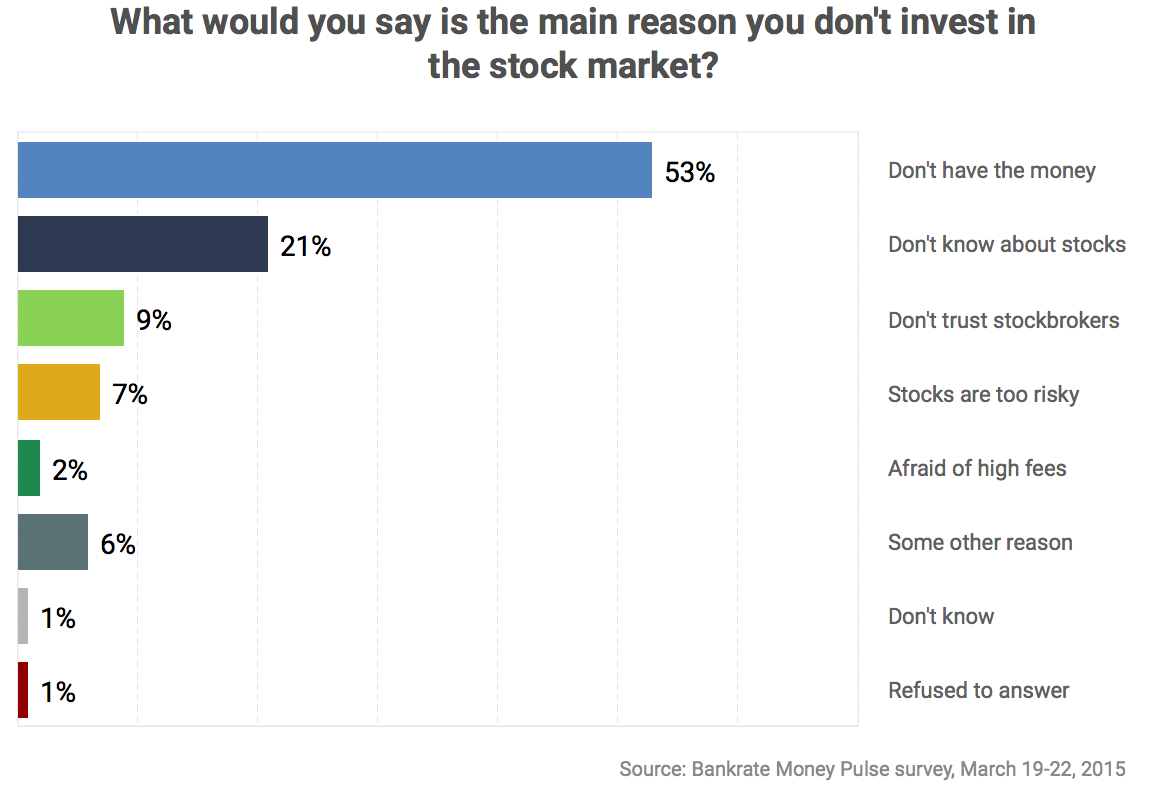

According to the Bankrate.com study, the main barrier preventing people from investing was a lack of extra funds, with 53 percent of respondents citing that excuse. Meanwhile, another 21 percent of would-be investors said they just didn’t know enough about stocks to invest, and another 9 percent said they didn’t trust stock brokers enough to pour any money in. Other popular reasons included the idea that “stocks are too risky,” or that the fees for investing were too high.

While it’s easy to understand why someone living in true poverty might not invest, the other excuses people use are much harder to stomach. Sadly, buying into one of these ideas can hold you back from the retirement you truly deserve.

But where do these big misconceptions about investing come from, and why do people believe them in the first place?

Investing Lies People Actually Believe

To find out which investing lies proliferate the most – and why they are absolutely false – we reached out to an array of experts in the personal finance community. Here’s what they said:

Investing Lie #1: You don’t need to worry about retirement or investing while you’re young.

While it’s sad that less than 50 percent of adults own any equities, the numbers get even worse for millennials. As the Bankrate.com study showed, only 26 percent of adults ages 30 and under owned stock in 2015.

Former portfolio manage Barbara Friedberg of Robo Advisor Pros offers an example that illustrates while investing young is not only smart, but a crucial move if you hope to retire rich – or retire early.

“Start investing at age 25 and put away $300 per month into stock and bond mutual funds earning an average 7% and your $144,000 investment is worth $791,948 at age 65,” says Friedberg. “But wait until age 35 to start investing (invest $300 per month from age 35 to age 65 and earn same 7%) and at age 65 your $144,000 investment is worth $368,000 or less than half.”

While young people many not think they can afford to invest in stock while they’re young, their future self would disagree. By starting early, you can set yourself up for life – and with much less effort on your part. So, why wait?

Investing Lie #2: Investing is selfish.

Here’s a really strange excuse that you hear quite often. With the “greed of the 1%” constantly in the news, you’re destined to come across people who say that investing is “selfish” at some point in your life. Why?

Because investing your money means depriving those who need your help from your money, not giving your kids the best, or not supporting charities to the fullest – at least, in their eyes.

C.P.A. Phillip Taylor of PTMoney.com says the exact opposite is true.

“The truth is, saving for a stable retirement is one of the most selfless things you can do with your money,” says Taylor. “Those who don’t become dependent on the system for 10-20 years at the end.”

And that costs everyone money. Worse, not saving enough could mean saddling your children with your expenses when you’re too old to work. Now, that’s selfish.

Investing Lie #3: I don’t have any money to invest.

While this is actually true for those who live below or at the poverty line, most people with regular jobs and incomes can afford to invest at least some of their money for the future. It may not seem that way if they’re living paycheck-to-paycheck or struggling with debt, but most people can free up funds to invest if they cut their spending elsewhere and make investing a priority.

If your employer offers a work-sponsored retirement plan that is tax-advantaged, it’s pretty likely you could set aside pre-tax dollars for retirement without seeing much of an impact to your take-home pay at all. And if your employer offers a match, you could easily earn free money for retirement. No matter what, you can’t beat that!

If you’re stuck saving for retirement on your own, on the other hand, finding a way to invest small sums of money is the best way to get started.

While some firms require $1,000 or more to open an account, other firms like Fidelity let you open certain types of retirement accounts (like a Roth IRA or traditional IRA) with no account minimum.

The bottom line: Small sums invested over time can add up to something substantial, but only if you get started.

Investing Lie #4: You shouldn’t invest if you’re in debt.

While a lot of people start saving for retirement the second they get a job that offers retirement benefits, other people put it off until they are able to pay off their debts. Since debt is so common – and many people spend decades paying off student loan debt alone – this can be a huge mistake with costly consequences. The longer you put off saving for retirement, the less time your money will have to grow.

Julie Rains from Investing to Thrive says you can and should invest while paying down debt; you just need to be smart about it. It can make sense to pay down really high interest debt before you pay down debt, she says, and you have to make sure your bills are covered, too. But after that, you should focus on both sides of the equation – reducing your liabilities while growing your wealth.

“You can invest and pay off debt at the same time,” she says. “When you invest, — even while carrying debt — you can start to see possibilities for growing wealth and that can motivate you (and help you) to live more responsibly.”

But, how do you know when to pay down debt first? Let’s say you’re carrying $10,000 in credit card debt at 18% APR. If you pay a minimum payment of $400 per month, it will take you 161 months to become debt-free – and you’ll pay $5,873 in interest in the process. Since it’s pretty unlikely you’ll earn an 18% return in any of your investments over a period of 161 months, it might be wise to kill those debts off before you invest.

If all you have is low interest student loans or a mortgage, on the other hand, investing for the long haul while in debt is probably a smarter choice. Basically, if the interest rate is lower than your expected rate of return on your investment, then theoretically the investment is the better choice. Keep in mind that the more time your money has to compound and grow, the better off you’ll be!

Investing Lie #5: You need to have a thorough understanding of the stock market before you invest.

The fact that 21 percent of adults who don’t invest base their decision on the fact they don’t understand the stock market is very telling – and also, very problematic.

By not learning investing basics or taking the time to understand, these people are setting themselves up for a truly sad retirement scenario – one where they won’t have enough money stashed away, and may have to live on government benefits alone.

Even worse is the fact that the premise behind this excuse is an utter lie.

The basics of investing in the stock market are shockingly simple: You purchase shares of companies in the US economy, and if they perform well financially, then your shares increase in value so that when you retire you can sell them to live off of.

Even if you don’t know the first thing about investing for the long haul, it’s easy to invest your money with several different strategies.

Investing in target-date funds such as Vanguard’s allows you to stash money away through diverse instruments including stocks, bonds, and short term reserves that will adjust for the ideal level of risk as time goes on.

Meanwhile, “everyday index funds are a simple way for anyone to invest with no stock market knowledge required,” says Teresa Mears of LivingOntheCheap.com. A broad market index fund such as the Russell 2000 allows you to diversify across a large basket of companies in a wide variety of industries and pay very low fees.

Opening a retirement account online and investing in one of these types of funds is also a piece of cake. And if you need help, the best robo-advisors offer an array of resources that can help point you towards the best funds for your needs.

Just like traditional financial advisors, most robo-advisors do a lot of the heavy lifting for you. Betterment, for example, analyzes your current strategy and offers suggestions on how you can improve your portfolio. Meanwhile, Betterment’s RetireGuide looks at your current portfolio and goals to create a series of suggestions that can help you reach financial independence sooner. Best of all, all of this can be done online – meaning you won’t have to schlep into a financial advisor’s office if you don’t really want to.

Investing Lie #6: I’ll never retire anyway.

The worst investing lie is one we conjure in our own minds, and it’s probably the most damaging. If each of us had a dollar for each time a twenty-something or thirty-something said they would never retire in their lifetime, we would all be rich.

This is less of an excuse, however, and more of a commitment to failure. It’s saying you don’t think you could save enough to retire anyway, so you won’t bother to try. It’s throwing in the towel before you even get started – quitting before you even reach the starting line. And quite frankly, it’s rather sad.

While you may think the world will end before you hit retirement, or that you’ll “die early,” chances are fairly good you’ll live to endure the consequences of not saving for retirement. Don’t believe me? Consider these facts from the Social Security Administration:

- A man reaching age 65 today can expect to live, on average, until age 84.3.

- A woman turning age 65 today can expect to live, on average, until age 86.6.

You can tell yourself whatever you like, but the fact is, you’ll probably live for a very long time. Another fact: If you don’t save for retirement, you’ll probably live those last few decades poor, on government assistance, or struggling to work part-time.

Raise your hand if you want to work until you’re 80!

Anyone?

Investing Lie #7: It’s too late to start, why bother?

You’ll always need to provide for yourself financially, so even if you’re 70 years old and have nothing set aside for retirement, you should start budgeting and saving, especially since the average life expectancy is well into the eighties now.

The Bottom Line

The fact that half of Americans aren’t saving anything for retirement is downright scary. Without the proper government services in place, the vast majority of these people will be forced to subsist on government benefits alone as they live out their final years. If you don’t want to be one of them, now is the time to get real about investing for the future.

You may think you can’t afford to, but you can’t really afford not to.

You might think it’s too “hard” or “complex,” but an array of investments are so simple a child could understand.

You might believe that investing is selfish, but you should ask yourself if you want to be a burden on society in the future. And if so, isn’t that selfish?

The excuses people don’t invest their money abound, but you would be wise to ignore almost all of them. At the end of the day, excuses won’t help you get ahead; they can only hold you back from the retirement you deserve.

2 Comments