Deprecated: Implicit conversion from float 1758202423.156436 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Deprecated: Implicit conversion from float 1758202423.156597 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Your retirement is one of the most important aspects of personal finance management. Taking the right steps for retirement savings today could be the difference between retiring in luxury at your beach house or living in a van down by the river!

401(k) and Roth IRA accounts each offer important benefits and should have a spot in your retirement preparation.

Differences Between A Roth IRA vs 401(k) In A Nutshell

| 401(k) | Roth IRA |

|---|---|

| No taxes paid until retirement (then taxed at marginal rate) | No taxes paid on investment gains |

| Reduces taxable income (pre-tax income) | Does not reduce taxable income (post-tax income) |

| Limited investment options | Flexible investment options |

| Employer plan options may charge high fees | Avoid fees charged by 401(k) accounts |

| Penalty for early withdrawal | Penalty for early withdrawal |

| $18,000 annual contribution limit for 2016-2017 | $5,500 annual contribution limit |

| Employer can match contributions | No employer match |

Read on to learn about how both accounts work and how you can use them for a successful retirement.

What is a 401(k)?

A 401(k) is a tax advantaged retirement savings account available through your employer. Not all employers offer 401(k) plans, but most large companies offer some sort of 401(k) with an option for matching contributions.

In those cases, for every dollar you put into your 401(k), your employer matches a certain percentage up to a limit. If your employer offers 401(k) matching, make sure you are taking 100% advantage of the match. That is free money you don’t want to leave on the table!

401(k) contributions are made pre-tax. This means you do not pay any income taxes on money that you contribute to your 401(k) account.

For example, if your top tax bracket is 28%, every $1,000 you put into your 401(k) each year lowers your taxes by $280 in that year. Your 401(k) investments can grow in that account without paying taxes until you reach retirement.

When you retire and withdraw from the account, you pay income taxes at your current tax rate, but seeing as you don’t have a full-time job in retirement, your taxes should be quite a bit lower.

If you decide you need to draw from your retirement funds before you reach retirement age, the IRS charges you taxes and penalties for early withdrawal.

But that shouldn’t keep you from saving and contributing to your 401(k), it should motivate you to leave that money alone until you are actually ready to retire.

Where Should I Keep My 401(k)?

401(k) accounts are notorious for charging high fees for both the account and your limited investment options. It is worth keeping your 401(k) open and contributing as long as you are with your current employer despite the fees so you can take advantage of matching and tax savings.

Once you leave your employer, however, you can take your 401(k) with you. You have the option to roll it over into an IRA that you control or a new employer’s 401(k) plan.

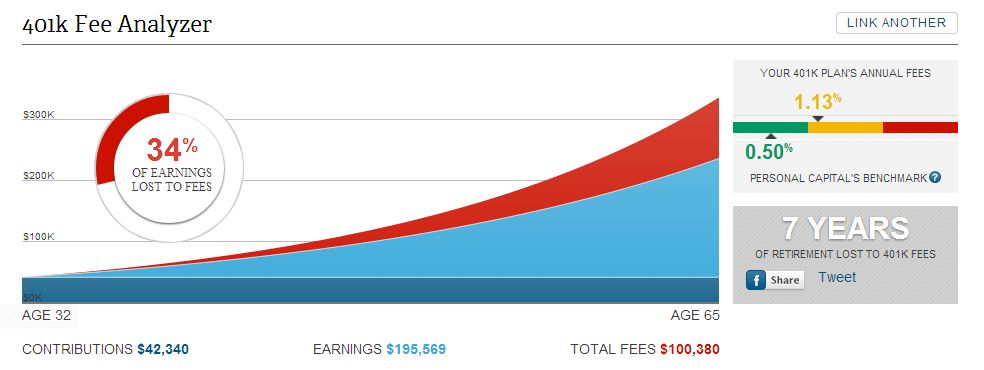

For most people, your own IRA is the best option because it gives you the best investment options and you can avoid those expensive 401(k) fees. You can use the free 401(k) fee analyzer at Personal Capital to find out how much of your retirement is being eaten up by fees and how much you could save from a rollover.

Personal Capital’s free 401(k) fee analyzer quickly shows you how much the fees in your 401(k) plan are costing you.

401(k) Highlights

- Reduces taxable income

- Pay no taxes until retirement

- Employer matching

- Rollover to IRA when changing jobs

- Limited investment options

- Penalty for early withdrawal

- $19,500 annual contribution limit for 2020.

What is a Roth IRA?

Like a 401(k), a Roth IRA is a tax advantaged retirement account. However, there are many important differences. Unlike 401(k)s, Roth IRA contributions are after-tax contributions. That means you pay income taxes in the year you contribute to the account, but do not pay any taxes when you withdraw during retirement.

Continuing the example we used for the 401(k), assuming a 28% tax bracket, you have to pay all $280 in taxes this year when you contribute $1,000 to a Roth IRA. Your investments can sit in your Roth IRA for decades and grow, and unlike the 401(k), you don’t pay a cent of taxes when you withdraw during retirement. For younger investors far from retirement, this is the most advantageous retirement investment account.

Also, unlike a 401(k), your Roth IRA is completely independent of your employer. You can open a Roth IRA at any investment brokerage you choose and invest in anything you want. Mutual funds, stocks, and bonds are all fair game as long as your broker offers them.

Like a 401(k), there is a penalty for early withdrawal. You can make an early withdrawal penalty free for a first home purchase, but otherwise plan on leaving your money there until retirement. The current annual contribution limit is $6,000, or $7,000 for anyone 50 years of age and older.

Where Should I Keep My Roth IRA?

When looking at the 401(k) vs Roth IRA question, this is where Roth IRAs really stand out the most. Because you can keep your Roth IRA at any major brokerage, you can control the fees you are charged.

401(k) fees can be huge, but there are no annual fees to maintain a Roth IRA and you can choose low cost mutual funds that only charge around .1% instead of 2% or more.

Over time, that can add up to tens of thousands or even hundreds of thousands of dollars lost from your retirement. If you aren’t comfortable managing your investments on your own, you can also look to Personal Capital for a free investment check up or a fully managed investment account (for a fee).

Using Personal Capital to manage your Roth IRA helps kill two birds with one stone, as you get access to both a qualified, professional investment advisor and an account at Pershing Advisor Solutions, a Bank of New York Mellon Company.

With over $1 trillion in assets under custodial management, Pershing Advisor Solutions is a safe and trusted place to store your Roth IRA while under the care of Personal Capital advisors.

Roth IRA Highlights

- No taxes paid during withdrawal

- Flexible investment options

- Avoid fees charged by 401(k) accounts

- Penalty for early withdrawal

- $5,500 contribution limit

Roth IRA vs. 401(k)

Some people think they have to decide 401(k) or Roth IRA. That is absolutely not true. You can have both a 401(k) and a Roth IRA at the same time, and that gives you the best setup for retirement.

Contribute to get 100% of the employer match in your 401(k), then focus other retirement savings into your Roth IRA until you reach the limit, then go back to your 401(k) until you reach that limit.

If you can save up to the limit on both, you are going to be better off than the vast majority of Americans when you reach retirement.

Photo Credit: InvestmentZen via Flickr – Creative Commons Attribution License

1 Comment