Deprecated: Implicit conversion from float 1751513432.914251 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Deprecated: Implicit conversion from float 1751513432.914453 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Solid personal finance comes down to a straightforward equation:

Spend way less than you earn, invest the difference, repeat for a number of years until your nest egg produces enough passive income for you to retire.

We all know that is what we should be doing, the same way we know we should eat less calories than we consume over the course of a day if we want to get fit.

Yet most of us struggle to stay in shape. And often, it is because we don’t realize the impact of skipping an individual workouts, or having that second helping.

After all, a little can’t hurt, right?

Well, over the long term, just a little bit can hurt, big time! So do little finance tweaks we don’t do, costing us thousands, tens of thousands, and even hundreds of thousands over the long term. And no, it’s not about the occasional $5 latte.

Keeping Your Eyes on the big picture

Sometimes, we are so focused on the day to day we forget to look at the big picture.

Take my mother, for example. She lives a pretty frugal lifestyle and is always saving money on daily items. She will look for deals at the supermarket, rarely buy clothes, or go out to dinner. And that probably saves her a couple hundreds every month, compared to someone with a similar salary.

But on the other hand, she was still paying a 4.5% mortgage while she had the cash sitting on a 1% savings account, until I took her to the bank to pay it off. She was gifting the bank 3.5% interest on her hard earned cash, resulting in thousands of dollars over the life of the loan.

We are talking about sums no amount of frugal living can make up for. Countless hours she spent working hard, only to pay interest.

The same applies when you forego your car maintenance and end up getting a $1,500 car repair bill because you have waited too long. When you pay 19.99% APR on your credit card instead of looking for a 0% balance transfer card, or saving the money upfront before making a big purchase. You may not realize it, when your bill comes in convenient small monthly instalments, but trust me, it really adds up over time.

Furthermore, we all live busy lives where we don’t want to sweat the small stuff. The more decisions you make during the day (Can I really afford that? Is there enough on my account to buy a $2 chocolate bar?), the more difficult it will be to focus on what matters the most.

Successful people, like Steve Jobs, Mark Zuckerberg from Facebook or even President Obama are known for wearing a slightly different declination of a same outfit day in, day out. Other entrepreneurs know exactly what they’ll have for breakfast every day.

By removing small concerns from their daily lives, they have more brainpower for things that do matter. By focusing on the big items of your personal finance life, you won’t have to get lost over the minutiae of saving a few bucks.

A one time tweak can save you tens of thousands

Let’s have a look at a real example. Say your mortgage is $200,000 at 4.5% over the next 25 years. Your payments are currently $1,111.66 per month. Refinance at 4% and your new mortgage payment is $1,055.67. Not a big difference

Over the life of the loan, you will be saving $16,795.90 in interest. For a tiny 0.5% difference in interest rate.

These calculations were done under the assumption that you will have zero fees to get your new mortgage, but most online calculators will help you figure out the savings including all factors. Now $16,795 is real savings. If you make $20 after tax, that is 21 weeks you don’t have to work for the bank.

Better still, since you are used to paying $1,111 towards your mortgage every month, keep doing just that and overpay each instalment by $55. This will save you another $10,672 over the next 25 years, and you will become mortgage free 2 years earlier!

Interest rates have dropped quite a bit these past few years. According to BankRate, as of June 2016, the average 30 year fixed mortgage is at 3.69%. If you are able to refinance, a few hours worth of work can save you thousands.

If you haven’t looked into refinancing recently, take advantage of the current low interest rate environment and get banks to compete for your business by requesting a quote at a comparison site like LendingTree. It could save you tens of thousands, or even hundreds of thousands of dollars in the long run.

A one time tweak that could save you hundreds of thousands

An even bigger savings opportunity that often gets overlooked are the fees you pay in your 401k.

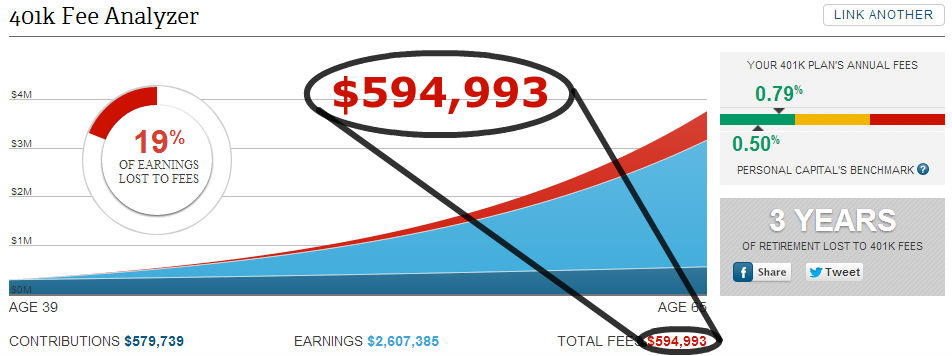

When InvestmentZen contributor Mr. 1500 ran Personal Capital’s fee analysis tool on his 401k portfolio, he nearly fell out of his chair. He discovered that with his current portfolio he was going to pay a whopping $594,993 in fees over the next 26 years:

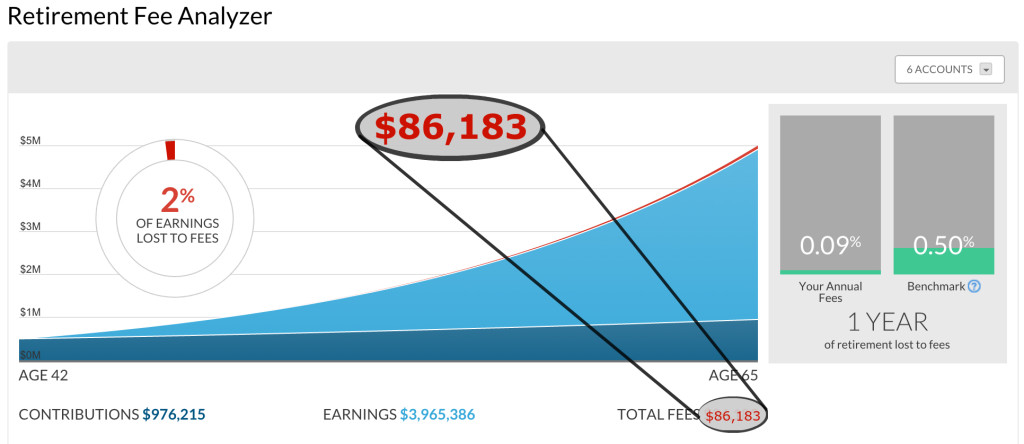

After seeing this, he spent a few hours moving his investments around and reduced his potential fees to just $86,163, saving him over $500,000 dollars.

How many coupons would you have to clip to realize that kind of savings?

It’s not difficult to do either. You can run the exact same 401k fee analyzer on your own 401k simply by signing up for a free Personal Capital here. Taking a few minutes right now to run the analysis could save you hundreds of thousands of dollars in the long run.

Finding Big Wins That Can Save You Thousands

Another big saving you should look into next is your credit card, if you are paying interest. A 0% balance transfer on $3,000 with a 4% fee will cost you $120, instead of paying $540 at 18%. You can apply for these online, and get an instant reply, saving yourself $420 for an hour of your time.

The same applies to personal loans, car loans, and pretty much anything you are paying interest on.

Most credit card providers will be happy to negotiate if you call them, and tell them their competitors are offering you a better rate. So play the game and shop around.

I apply a similar method to negotiate with my utilities providers. Every year, I look at broadband deals for new customers, and call my provider. I am reluctant to change since they have great service, but thanks to that 10 minute phone call, I have been kept on the new customer discount since 2009. It saves me $120 on average, a very lucrative phone call.

After you have done all that, you will note that your lifestyle hasn’t been impacted in any way. You are still living in the same house, driving the same car, life has just gotten cheaper.

Earning more trumps saving more

While making sure you spend less than you earn is a critical part of building wealth, there’s ultimately a limit on how much you can save.

If we look at the “earn more” part of the “spend less, earn more” equation to financial success, you can apply the same principles to identify big wins.

Asking for a raise every year, detailing to your boss how you have been a valuable asset to your company can increase your income by a few thousands. All you did was sit down with your boss for half an hour.

Invest that $3,000 raise at 8% for the next 30 years in a portfolio of low fee index funds (you can use a robo-advisor like Wealthfront or Betterment if you’re not comfortable balancing your own portfolio), and you will boost your nest egg by $354,000!

8 Comments