Deprecated: Implicit conversion from float 1751415642.746663 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Deprecated: Implicit conversion from float 1751415642.746785 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

So you’ve started planning for the future by putting money into a 401(k) to fund your eventual retirement. How can you handle the unexpected expenses that appear along the path? Even if you have an emergency fund, major life events can deplete that fund quickly, leaving you unable to cover your living costs.

The IRS understands that these kinds of situations can come up, so they make it possible to make a 401(k) hardship withdrawal in times of dire need. There are a number of rules and costs involved, so only be used as a last resort.

Here is a simple breakdown of 401(k) hardship withdrawal rules.

What is a 401(k) Hardship Withdrawal?

A 401(k) is intended to be used as a place to save money until you reach retirement age. Because the government wants to encourage people to save, it allows you to deduct your contributions from your income when tax day rolls around. Normally, you’re not allowed to access the money until you turn 59½, preventing you from spending it before retirement.

A hardship withdrawal is a way of accessing the money you’ve saved in your 401(k) before you turn 59½, assuming you meet the requirements.

When Can I Take a 401(k) Hardship Withdrawal?

According to the IRS, for a distribution from a 401(k) to be considered a hardship withdrawal, it:

“must be made on account of an immediate and heavy financial need of the employee and the amount must be necessary to satisfy the financial need.”

In plain English, you have to have a specific need for the money, and you can only take exactly as much as you need.

There are six types of expenses that the IRS considers “immediate and heavy,” qualifying them for a 401(k) hardship withdrawal.

- Medical expenses for yourself, spouse, or dependent

- Costs relating to the purchase of your principal residence

- Tuition and related fees and expenses for yourself, spouse, or dependent

- Payments necessary to avoid eviction from or foreclosure on your primary residence

- Funeral expenses for yourself, spouse, or dependent

- Certain repair expenses for damage to your primary residence.

If you experience a hardship not listed, you’ll need to prove that it truly is a financial hardship by following the rules laid out in your employer’s 401(k) plan.

If you, your spouse, or your dependents have access to other resources, such as savings, you need to exhaust those before making a hardship withdrawal.

Put simply, you have to have a real, pressing, need for money and no other way to get that money to qualify for a 401(k) hardship withdrawal.

What is the Cost of a 401(k) Hardship Withdrawal?

When it comes to the IRS, nothing can be done for free and hardship withdrawals are the same.

First of all, you’ll need to pay taxes on the money you withdraw from your 401(k). The IRS wants its cut, and it gave you a break when you put the money into the account, so they’ll tax it as it comes out.

Next, you’ll be required to pay a 10% penalty on all the money you withdraw from the 401(k) as a penalty for receiving an early distribution. You can avoid this penalty if you are over the age of 55 or if you receive an exemption from the IRS, which is offered in the event of:

- Death or total permanent disability

- Unreimbursed medical expenses exceeding your income by a certain amount

- Qualified domestic relations orders

- And a few other limited circumstances.

In most cases, you’ll have to pay the 10% penalty.

On top of the costs, you’ll also be blocked from making contributions to your 401(k) for the next six months.

Even if you get through your hardship in a few months and want to repair the damage to your 401(k) balance, you’ll need to wait out the time limit. You will still be able to contribute to an IRA if you want to.

How Can I Actually Make the 401(k) Hardship Withdrawal?

Once you’ve read and understood the rules surrounding hardship withdrawals you can start the process for making the withdrawal.

How you initiate the process of making a hardship withdrawal depends on your 401(k)’s rules. You’ll want to speak with your plan administrator regarding the specifics of starting the process.

Be ready for a lot of paperwork and a waiting period before you actually get access to the money. You’ll have to prove hardship to your plan administrator and the IRS, sell your investments, and get the funds transferred, so if you foresee a situation that could require a hardship withdrawal, it’s best to get the ball rolling early.

401(k)s are a great tool for saving for retirement, but sometimes unexpected expenses pop-up before your golden years. When that happens, a 401(k) hardship withdrawal is a last resort option to meet your pressing financial needs.

A Note On Uncovering Hidden Fees In Your 401(k) Investments

While the following might not seem applicable to you if you’re in the process of making a 401(k) hardship withdrawal, its still important to plan for your long-term future.

Most of us severely under-estimate the impact that fees can have on our retirement. Thanks (or no thanks) to the power of compound interest, even a seemingly harmless 0.5% difference in fees can cost you hundreds of thousands of dollars and delay your retirement by many years.

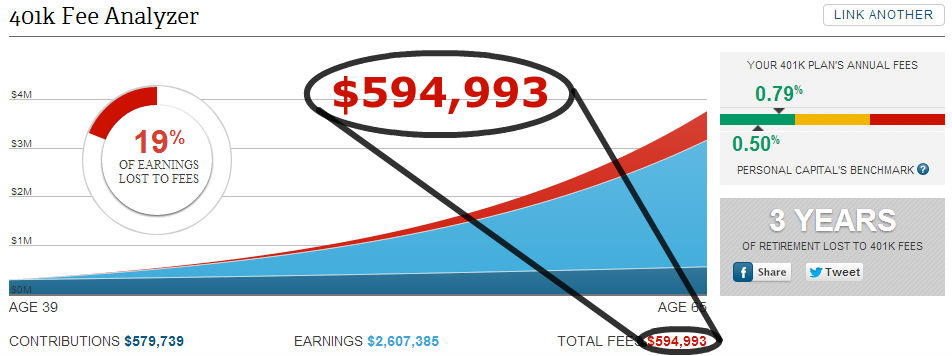

When InvestmentZen contributor Mr. 1500 ran Personal Capital’s fee analysis tool on his 401k portfolio, he was shocked by what he discovered. The free analysis showed that with his current portfolio, he was on track to paying a whopping $594,993 in fees over the next 26 years and losing 3 years of retirement, due entirely to hidden fees:

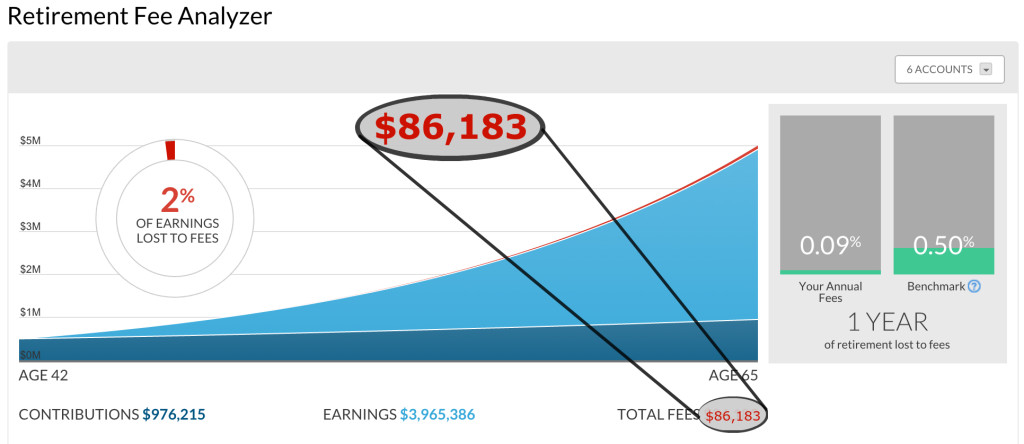

After making this discovery, it only took him a few hours of adjusting his portfolio with the help of Personal Capital’s fee analyzer to reduce his potential fees to just $86,163, saving him over $500,000 dollars and shaving 2 years from his path to retirement.

If you want to get the most out of your 401(k) investments, signing up for a free account at Personal Capital to take advantage of their free investment fee analyzer is an easy way to do it.

It could potentially save you $500,000 dollars (or more).

And did we already mention its 100% free?

Photo Credit: investmentzen Retirement Plan Keyboard Button via photopin (license)