Deprecated: Implicit conversion from float 1757997749.509029 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Deprecated: Implicit conversion from float 1757997749.512454 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

“Can you just order the usual for me, I have a quick phone call, I’ll meet you there” I whispered to my co-worker as he headed out the door.

Back to my cell phone – “what can you tell me about the neighborhood?”

That was me on a lunch break in 2011 – pacing outside the office, interviewing someone thousands of miles away.

“What is the reputation? Who is a typical tenant?”

I was on a mission to learn everything I could. This person had firsthand knowledge of somewhere I had never been and I needed to know.

In a way my life – my financial freedom – depended upon it.

How did I end up on the phone that day learning about a rental property investment on my lunch break? I arrived at a few important conclusions.

Saving Isn’t Enough

“Save 10% of everything you make” your rich great-uncle tells way too many people, including strangers in the grocery store.

Is that all? Am I now going to be rich like he is when I’m older?

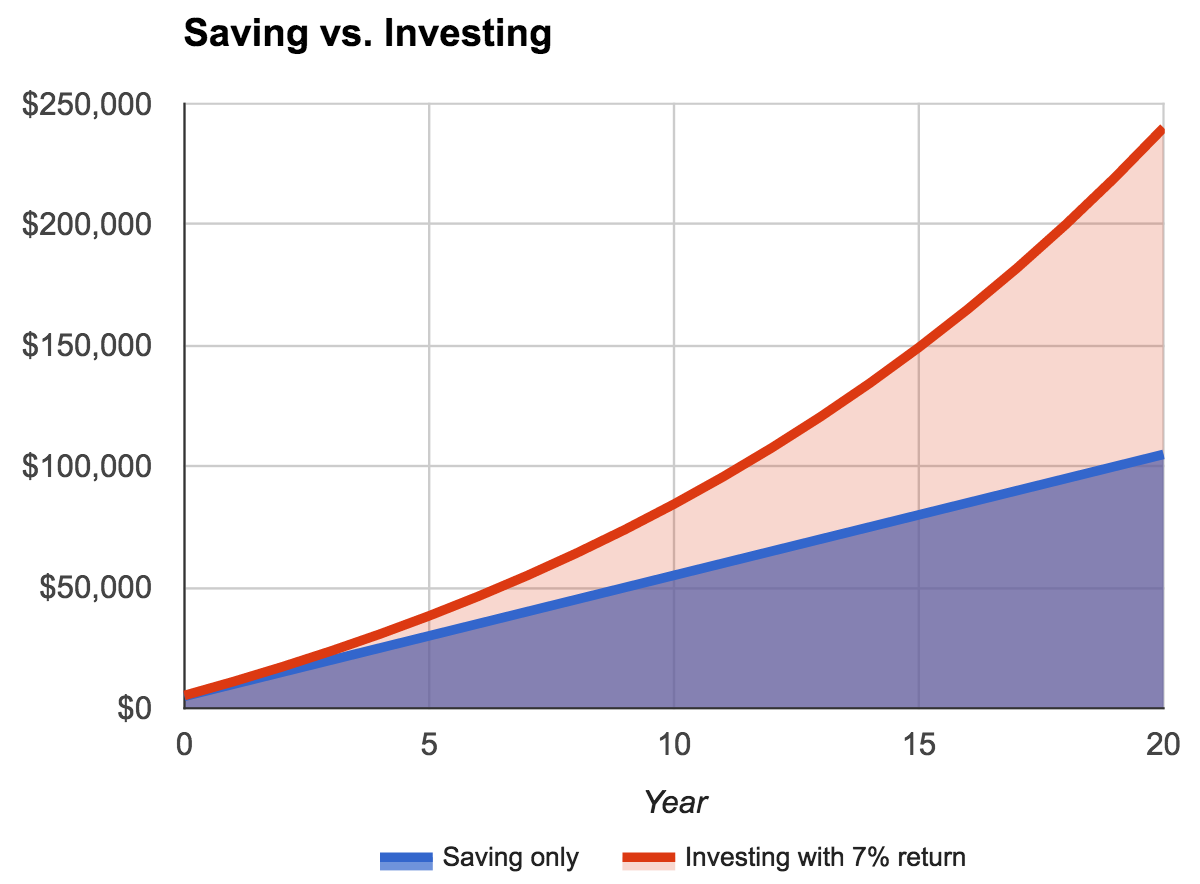

Not likely. Have you ever seen one of those charts that compares saving to investing?

Hypothetical time. You are pretty young and will work at least another 20 years. Let’s say you make $50,000 and save $5,000 a year, following your great-uncle’s advice.

Scenario 1: you put the money under your mattress (about the same result as a savings account at a big bank)

Scenario 2: you invest in the stock market with an average 7% yearly return

When you invest, your money works for you. It pays a fraction back to you every year. That fraction is then put to work too, earning a fraction of a fraction.

Pretty quickly these fractions add up. That is the magic of compound interest.

Conclusion #1 – I am going to have to invest

What if the Default Approach Isn’t Enough?

Maybe you get it. You already save and invest in low cost Vanguard index funds through tax advantaged retirement accounts.

Do you think just because you follow this smart advice, you will automatically end up where you want to be?

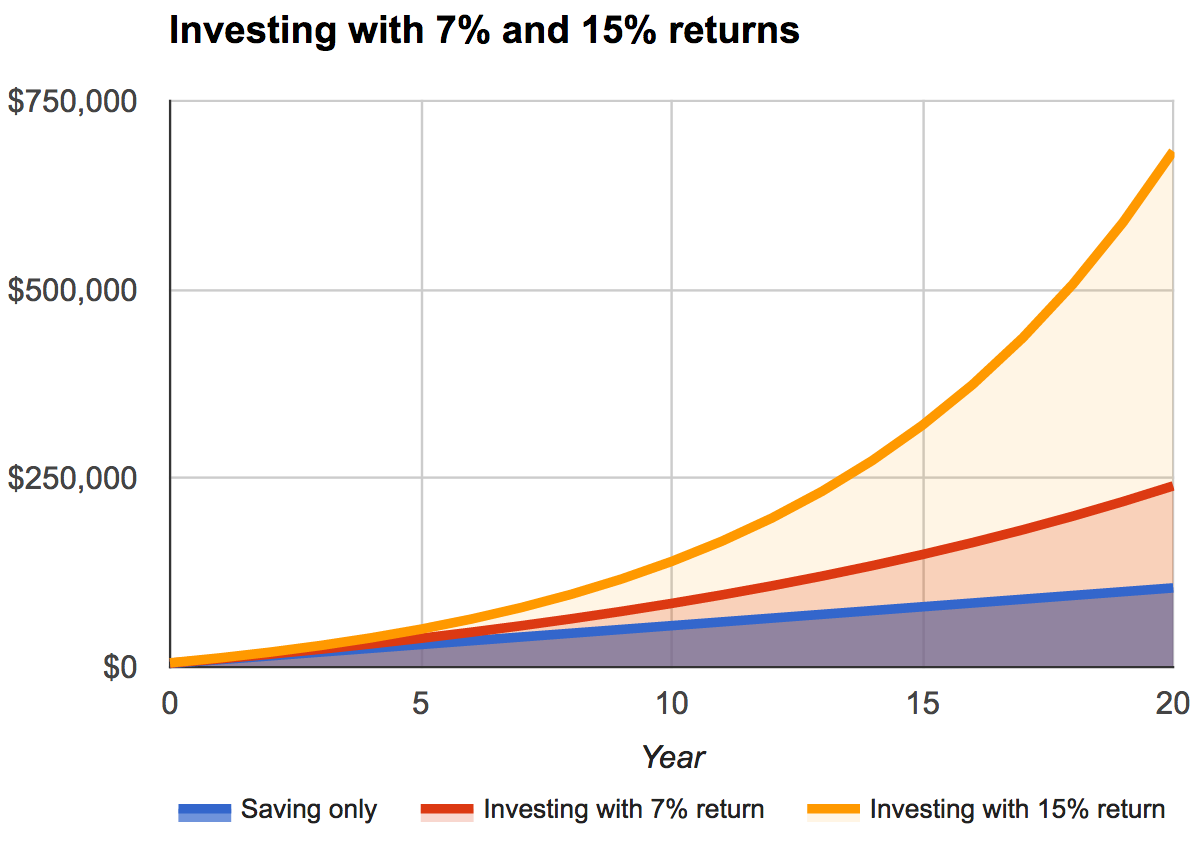

The scenario with saving 10% of your paycheck and investing for a yearly 7% return, after 20 patient years, you will have less than 5 years of living expenses. Ouch.

Trusting everything will magically work out if you follow conventional advice isn’t such a good idea. Run the numbers and see for yourself.

Trusting everything will magically work out if you follow conventional advice isn't such a good idea. Run the numbers and see for yourself. Click To TweetConclusion #2 – the default approach isn’t good enough

Luckily there are plenty of ways to get much better financial results. You can:

- Earn more

- Save a higher percentage by lowering expenses

- Work more years

- Earn a greater investment return

You have limited time though, so which should you focus on?

The Surprising Place Where Your Effort Has the Biggest Impact

Earning more might be the best starting place, but I was already making pretty good money. So should I try to earn even more?

Let’s take a look at earning a greater investment return. Here is the same chart comparing a 15% return vs. a 7% return:

The money stacks up so fast we really had to zoom out!

Think it is possible with a little hard work? If so, it is obviously worth the effort.

Conclusion #3 – Doubling my investment returns is worth whatever effort it may take

Somehow we ended up in a world where investments take zero thought. Anything other than the default path is labeled “risky”.

Yet for hundreds, even thousands, of years people have been renting a place to live. Sounds pretty proven to me, and much better than “the world’s oldest profession” (wink wink).

It is a unique investment where the little guy has an advantage. You can invest $15,000 or $20,000 at a time as a down payment on a single family home – such a small deal sophisticated Wall Street doesn’t even bother (if fact, Warren Buffett once said he would buy a couple hundred thousand single-family homes if it were practical).

With today’s technology, these investments can even be thousands of miles away from where you live.

When you consider all the ways you earn a return on a rental property – rent income, appreciation, paying down the mortgage, and more – a 15% return is very achievable.

So this became my goal.

Conclusion #4 – rental properties are the best place for a not-wealthy-yet person to use their effort to generate a greater return

The Hardest Part is the Start

There are millions of people out there who would like to one day be real estate investors. Hundreds of thousands are on the BiggerPockets forums who have never done a deal.

It’s not easy, there is a lot to know.

I separate education into two parts – passive and active.

Passive education is reading books and browsing the internet for information. This is necessary to get the basics down and learn the lingo. It is safe, no one has to know you are even interested.

Active education is when you generate conversations with the right people and ask the questions. This makes the learning specific to your situation and goals.

Active learning is uncomfortable. What if I say something dumb? Ahhh!

It is worth pushing through that discomfort – active learning is 10 times more powerful than passive.

Conclusion #5 – get to active education as soon as possible

Working the Phone on My Lunch Break

I generated conversations with investors who started where I started, lenders, property managers, rental property investment advisors, contractors, and property sellers.

Most of these people will want to talk to you. They see you as potential business, so will answer your questions and explain how it works.

However, they won’t devote infinite time to you. You might be able to talk for 15 or 30 minutes, but at some point they will stop seeing you as a lead and just another person who won’t take action.

It works best to set up an appointment for your phone call. That way they aren’t in the middle of something and in a hurry to get off the phone.

When you do get that appointment – be prepared – have a list of questions you would like answered. Your list of questions will improve with each person you talk to.

If you say something dumb? Don’t worry, you never have to talk to that person again. For example, there are a thousand other lenders you can learn from and eventually work with.

At some point my phone calls went from simply a learning exercise to interviewing for my eventual team of experts.

The Start of a Long Journey

The short lunch time phone calls back in 2011 were just the beginning.

I was only 25 then without much in the way of savings, so it didn’t lead to a deluge of deals. But getting started is the hardest part.

In almost 6 years I have a 29% yearly overall return – even higher than expected thanks to some lucky market timing. While that number might not be sustainable, the goal of 15% isn’t nearly as intimidating to me now.

What do you think – can phone calls on your lunch break be the kick in the pants you need to get started on the journey to financial freedom?

Follow Brian’s journey and learn how beginners can get started with rental property investing at Rental Mindset.

7 Comments