Deprecated: Implicit conversion from float 1752881570.978124 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Deprecated: Implicit conversion from float 1752881570.978289 to int loses precision in /www/investmentzen_357/public/blog/wp-content/plugins/intelly-related-posts/includes/classes/utils/Logger.php on line 93

Financial independence is a pretty cool concept. Having enough money to cover your expenses for the rest of your life would allow you to do whatever you please with your free time, enjoy life, and work only if you really want to.

But is it really for you?

I have been financially independent for a few years now. And naturally, a ton of friends and family members, intrigued and attracted by my lifestyle, have come to ask me how to get there.

When I start explaining that you need to save and save, and save some more, for years and years, I get blank stares. People shrug it off and keep doing what they were doing. How can you expect different results if you keep on doing the same?

You can’t. Financial independence may not be for you if…

1. You’re not serious about it

I would love to run a marathon. I went from couch potato to semi serious runner, running an hour every other day. Then I stopped. I haven’t run in weeks, if not months.

I know how to run a marathon. You just need to run a mile, and repeat 26 times. I know if some 80 year olds run marathons, I am perfectly able to train for one and finish it. Yet I am unable to, because I am not serious about it.

Financial independence is a marathon. You know the basics, earn, save, invest, but unless you diligently repeat the steps month after month for a decade or two, you will never get there.

Financial independence is a marathon, not a sprint. Click To Tweet

2. You don’t get it

Like with any goal, you have to know what you are working towards. Eating broccoli for lunch might feel miserable until you realize you are doing it to be healthier and look fitter.

I started saving back in high school. I didn’t know anything about financial independence yet, but was aware that everything I bought was a result of me working for a number of hours. A cool new CD player? About 10 hours. Fancy pair of jeans? 8 hours. I could choose to work for it, or forego the purchase. Then it got interesting.

A few years later, as I was working my first cubicle job, I figured out that if I could save a day worth of expenses, I wouldn’t need to work for a day. Saving 50% of my income meant not having to work for a whole month, since I could live on half my salary!

Financial independence is freedom you are buying for your future self. Picture your future life of freedom, and it will make much more sense to delay gratification.

Financial independence is freedom you are buying for your future self. Click To Tweet3. You live like the world is about to end

Who wants to save money and make sacrifices today if they think they won’t be around 30 years from now? No one. If your life motto is YOLO, because life is short and who knows if you will make it past 50 anyway, financial independence is not for you.

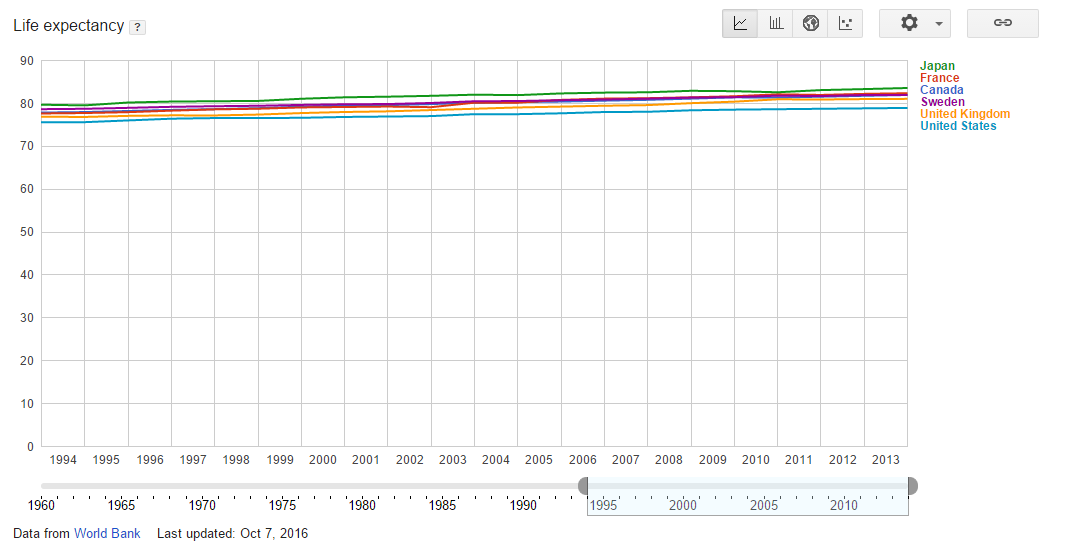

But all the statistics are against you. Your life expectancy is 79 years if you live in the US. 82 years in Canada and 81 in the UK (source).

If you are 30, you have 49 years to budget and pay for ahead of you. I wouldn’t count too much on social security, just in case. Working in your 60s won’t be fun if you can’t afford to retire.

4. You don’t enjoy the small things

Financial independence starts with drastically reducing your expenses so you can increase your saving rate.

In the personal finance world, you will find all sorts of diaries, from people cutting on stuff that do not bring them value, such as a shopping ban if they still have nice clothes in their closet, or the cable TV they barely watch anymore, to extreme frugalistas who eat rice and beans 360 days a year.

While I am not a frugal advocate when it comes to wearing three sweaters in a freezing house, I am all for frugal fun rather than spending hundreds on expensive activities. Hiking, cycling, board games, cooking great dinners at home instead of going out, come to mind. The small pleasures in life are free or cheap, and will help you boost your saving rate while staying social.

5. You are average

I’ve discussed this in length in a previous post. Being average is dangerous for your financial future.

“But, I make more than my neighbor!”

Yes, and he won’t retire in style, either. Making an average $50,000 per year and saving an average 5% will take you nowhere. You nest egg will be shy of $200,000 after 40 painful years of compounding at an average rate of 3%.

Enough to withdraw a whopping $8,000 a year, barely sufficient to cover two months worth of expenses, since you are living on $47,500. Don’t be average.

6. You don’t track your money

If you’re doing ok, but too busy to take care of your money, you might be losing thousands of dollars every year.

The overdraft fee when you didn’t remember to fund your checking account and bills came due. The interest you paid on your credit card because you missed the payment date and didn’t set up automatic transfers. The $5,000 lingering in a 0.01% interest savings account for the past year.

And all the little things you spend on, or get billed for, but don’t get value out of. Little amounts do add up. Tracking your money for a month or two will help you identify quickly where you can save more. After that, it is just a question of conducting a quarterly or even annual review.

If you’re not sure where to start with tracking your money, check out Mint or Personal Capital.

7. You don’t like to invest

Going back to getting average returns, even with a high saving rate, your road to financial independence will be much longer than needed.

Save $500 a month at 3% for 30 years and your nest egg will be $292,000. Not much to show for after a life of decent saving.

Save $500 a month at 8% for 30 years and you will have $750,000 in the bank. Enough to withdraw $2,500 every month for the rest of your life, using a safe 4% withdrawal rate.

What brings you higher returns than the bank? The stock market, real estate, alternative investments to name a few. With real estate, there can be a level of management you may not be willing to undertake. Tenants are a pain sometimes, I get it.

But the stock market, or peer to peer lending are easier than you think to get into and can give you higher returns. The returns are in correlation with the risk involved. Something as straightforward as investing in index funds and forgetting about them for a few years can be a start. The S&P500 has returned 9.79% from January 1987 to January 2017, reinvesting the dividends (you can look up more stats here). That’s pretty solid.

Stock picking requires time and skills, but with indexes and robo-advisors, you can set your preferences and invest a regular sum every month, dollar cost averaging your portfolio.

Financial independence doesn’t have to be complicated, but it also isn’t for everyone.

Will it be for you?

Photo credit: InvestmentZen Images – Creative Commons Attribution License

2 Comments